The EU government is now positioning itself to tighten up online gambling rules as business is flourishing across the continent. These new regulations will soon take effect across Europe and will strategize a taxation on a $US37 billion online gambling industry. They are currently in talks to hammer out a deal.

Online gambling is a hot-button issue in many European states, who see it both as a source of revenue with potential to harm.

Lawmakers have recently had start-and-stop talks with industry leaders, and this back and forth underlines how challenging doing business with the industry is. Some European governments have started overhauling their online gambling regulations, a move that will add costs for major online gambling companies to do business in these countries. The new rules should clear up the legal ambiguity around the industry, who currently are all based in offshore low-tax regimes such as Malta, the Isle of Man, and Gibraltar.

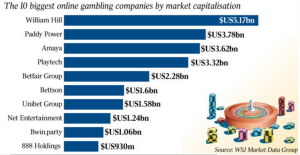

Recent takeovers and deals within the industry to strengthen their position in the market has taken place. And example is from this past week where Britain’s 888 Holdings, one of the sector’s biggest competitors, ended talks over a proposed £720 million ($1.4bn) takeover by British bookmaker William Hill. 888, who are based in Gibraltar, reported talks broke down after they couldn’t agree on price. Bwin is also being courted by a few suitors, who for the last year has been in talks with various parties considering potential business combinations. Bwin shares have recently fallen as investors and analysts appeared to have given up hope that a deal might be worked out.

These types of deals has had investors and analysts expecting an increase in deal-making and have made governments aware that legislation is needed.

The British government now requires operators to get licences and will start taxing online companies’ British revenue. That means a new EU “digital tax” will be in play and will soon spread across Europe.

These new rules will also affect the industry’s smaller European competitors. They will face the same increase and higher regulatory costs and taxes as the bigger players, which will be tougher to balance against their spending on development and marketing. For this reason many smaller companies are trying to invest in a new industry of social gaming, where casino-like games are offered to casual players, with no prize but play money, credits for which players need to pay with real cash. Made for play on smartphones and tablets, this industry already brings in billions of dollars in revenue per year.

As an example Bwin, invested $US50m into social-gaming, research and development which was based mostly in Israel and Ukraine. But it reported a loss of $US8.4m last year. Bwin said the new EU taxes would further reduce its 2015 net revenue by about €15 million, and in consequence hundreds of its employees in India were let go in trying to consolidate their gambling-development divisions there.

European Gambling Sites Will Have to Adapt to New EU Taxation Policies

The EU’s is focus on tightening their rules to regulate the fast developing online gambling industry, is to better protect minors and coordinate a huge and fragmented market.

“We must better protect all citizens, and in particular our children, from the risks associated with gambling,” said Michel Barnier, the EU’s internal market and services commissioner in a recent interview with media.

He continued, “We now look to the member states, but also to online gambling operators, to match our ambition for a high level of consumer protection throughout the EU in this fast growing digital sector.”

Maarten Haijer, head of the European Gaming and Betting Association added, “European consumers deserve to be equally well protected throughout the EU, wherever they reside.”

These regulations are likely to translate into higher costs and taxes but eventually the strongest and best businesses will thrive because of them. The European gambling industry, eager for less fragmentation, will welcome the recommendations that are necessary for this cross-border internet sector to function more safely and efficiently.